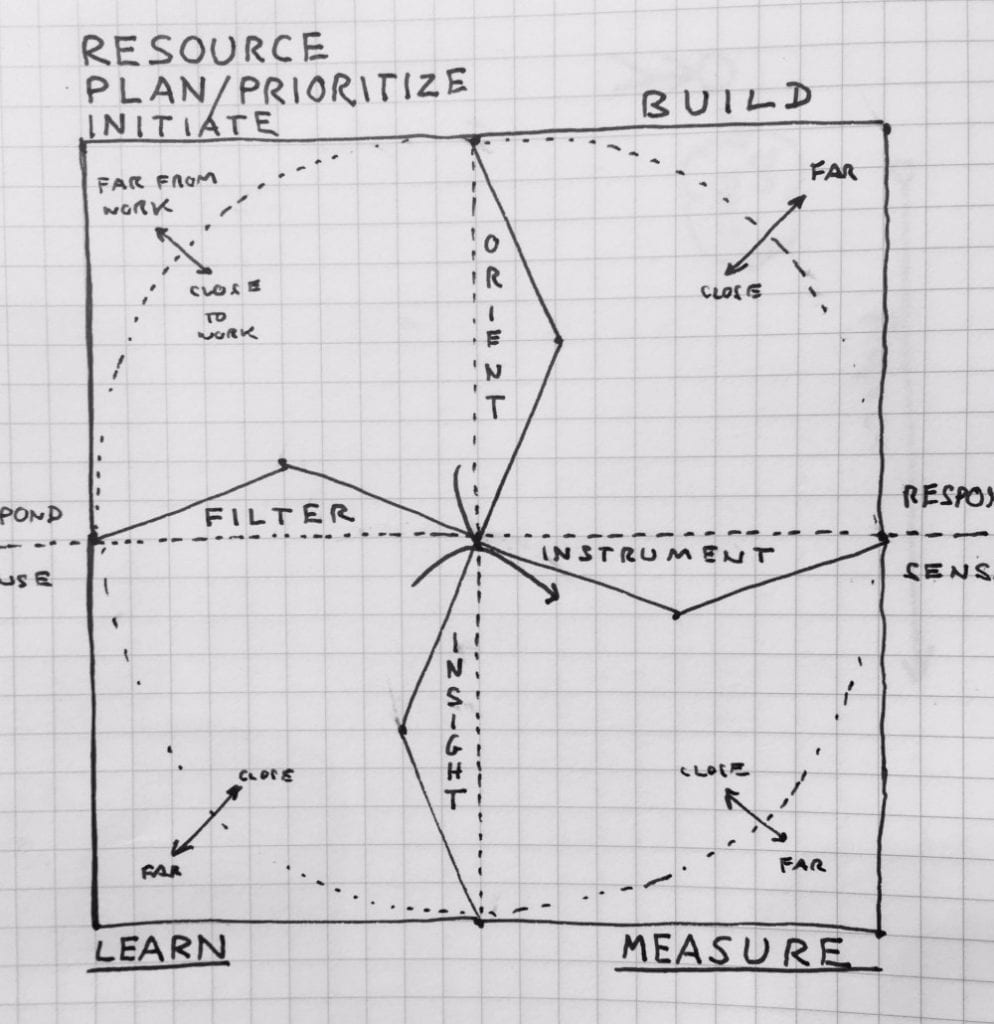

Professional Services Innovation: Customer Insight, Expertise, and Technology

Professional services innovation requires deepening your understanding of customer needs and emerging problem areas, deepening expertise, and incorporating technology and specialized tools into service delivery.

Professional Services Innovation: Customer Insight, Expertise, and Technology Read More »