A conversation with Brendan McAdams about what’s involved in drawing a map of the customer organization as part of an enterprise sale.

Drawing a Map of the Customer Organization

I first met Brendan McAdams (@BrendanMcAdams) in August of 2020 when when he dropped by a Virtual Bootstrapper Breakfast. He is an experienced enterprise salesperson and author (see “Brendan McAdams on Sales Craft: Proven Tips to Elevate Your Sales“) We have collaborated on several projects including “Why is an Enterprise Sale So Complex? and Cultivating Luck in Business Endeavors and Relationships. We recently sat down for several conversations on drawing a map of the customer organization as a part of the enterprise sales process. this post is a summary of those discussions.

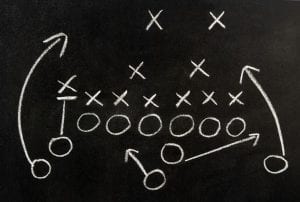

Brendan: When I think in terms of selling to an enterprise account, I find that using an organization chart as a fundamental component of my sales process is a very useful way for me to visualize the organization over time. And in a complex enterprise setting, there are multiple deals and lots of different time frames and priorities and politics that we can talk about.

Brendan: When I think in terms of selling to an enterprise account, I find that using an organization chart as a fundamental component of my sales process is a very useful way for me to visualize the organization over time. And in a complex enterprise setting, there are multiple deals and lots of different time frames and priorities and politics that we can talk about.

It’s like a map. I view it as a map and there are multiple different ways to look at that map. There are different kinds of relationships and there are different deals and different people, but they all pivot on who is the economic buyer in the organization for a given deal, who is your coach or your champion inside the deal and who the users are.

I find myself drawing a map of the customer organization whenever I’m dealing with a large account: it allows me to synthesize on one page a lot of the key elements that go into the deal.

Sean: In my early sales application engineering experiences, I worked for a couple of startups. It took me a long time to figure out that the sales process was more than just the demo and a conversation with purchasing. I came to understand that group inside the customer’s company had to come to a working agreement. I did not understand that there would be financial considerations in addition to the technical evaluation and that the relationship would be built over time. There might be an initial purchase, and then other groups might then make a purchase or the initial group might purchase more depending upon the results that flowed from the initial purchase.

About ten years later, I was working in marketing and was in a meeting where we were all sitting around the speakerphone waiting to call a prospect. The president and the sales guys were trying to draw a map of the customer organization on the white board. They were trying to document who the players were and what was the path the decision would take to make a purchase.

Who was part of the authorization process and then who were the technical influencers? Whose opinion was respected for the technical piece and then who had to sign off for the financial authorization? So there were two tracks we were chasing.

Brendan: It’s essential to identify who is involved in the deal and what their relationships are. If I do a thorough job with the org chart I can infer who I have not contacted that I need to contact. In Miller Heiman parlance: “Who’s uncovered?” I needed to contact an “uncovered base.” An annotated map of the customer organization gives me a visual representation of where the holes are in my sales strategy or sales execution.

For me it’s really useful because I am a visual thinker, I think a lot of people are. I find a diagram is a good way to identify and communicate key account information to other people in my organization. It allows others who are involved in the sale to see very quickly that “oh, we got to talk to this person. This person is our adversary at this point and they’re not, they’re not bought in and we have to do this.” And I think that’s where the org chart comes in.

Sean: At Cisco, I got involved with a hardware best practices, initiative. We had acquired 70 companies and needed to converge hardware design and development practices in a practical and useful way. We realized that we could leverage Cisco’s online employee directory to identify everyone involved in mechanical design, or printed circuit board design, or analog design and invite them to different special interest group meetings.

We realized that, if we were going to make a decision, for example, about mechanical design practices we needed to get everyone doing mechanical design, or at least someone from every team doing mechanical design to provide feedback.

We built up lists of everybody who had the title of PCB designer for example, and would invite them to take part. We also kept them informed as we proceeded so that we would not face last minute objections about “no one on my team was consulted” or “I’ve never heard about this.”

We needed to get a relatively complete picture of current practice and diagrams of what was going to change and who was going to have to sign off. I see that you are using your map for the same purpose. Where will your product impact customer workflows and practices, who will be affected as a result, who has to sign off to authorize the change?

Brendan: In a more general sense, I would say that your map of the customer organization should identify your blind spots: what might you be missing? If you can map out the whole organization or the affected parts of the organization–you may not need to map out legal or accounting, but you might–but if you can understand everyone involved in the decision in the organization, then you know where the potential holes are. You don’t know what you don’t know, but a visual map can help you see where some gaps might be.

Drawing the map of the customer organization not only allows me to identify gaps and communicate quickly with my team, it also enables me to see who may be impacted by the purchase who don’t get a vote. Users are often in this category. They may not have a very big role in the purchase design, but they have enormous influence on adoption. You need to identify who your evangelists will be, who will help you get the implementation going and drive adoption.

This can also happen with IT, someone may make a purchase and not involve them, but you will need their help to get it implemented.

From “Big Deal Up Front” to “Land and Expand”

Another situation where your map of the customer organization can be helpful then is understanding who is unhappy with the status quo. The truly discontent will be doing something now to solve the problem that your product is going to solve. So if you can map who is happy with the current solution and who is not, you are better served to focus on the discontented folks, not the happy ones. Kurt Lewin developed this model he called a force field diagram. You look at what forces are at work driving change in a particular group–or would drive consideration of your product–and then what forces would mitigate against it, prevent it, or slow it down.

Brendan: The way I would describe that is to understand who is motivated to see the deal go through because it’s a win for them. And understand who will view the project or deal as a loss. For the latter, if you’re a department head whose head count goes down because of this new technology, you may not like that. Even when the deal is good for most, it’s rarely good for all: pain and benefit are rarely equally distributed. People who are suffering under the status quo are normally in favor of change, but there may be others who aren’t suffering as much pain or they really like the status quo. So you have to identify those situations as well.

Sean: There is no gain without loss. I think you are right when you say that different people may feel a very different mix of gain and loss: job content, tasks they enjoy or hate, loss of status. If they’re an expert in an existing system and you’re doing away with that system, then there may be loss of status and a painful sense of lost expertise. That’s a very real pain for folks.

Brendan: In larger and more complex enterprises, politics has on a much greater role and can be a formidable adversary. Opposition in a small company can be “I don’t want to do this because it is more work to navigate the implementation and transition.” But it’s not normally resisted due to loss of status, headcount, and budget.

Sean: I think we exist in a web of relationships. There is a formal reporting structure with written procedures, and there are cultural expectations and unwritten rules about how we do things around here. The latter is as important as the former: it’s critical to understand how things work and how the process may vary in different teams or groups.

You need to do a certain amount of value stream analysis: you will have to point to where your product is creating more value for the customer–the actual end customer outside the building. As companies grow, they rely more on proxies for end-customer value. So the question becomes, “Will my boss be happy? What about her boss?” Because the bosses are close and the customer is far. But in a startup or a small firm, almost everyone is interacting with customers, so they have a more immediate sense of the value they are creating.

The headcount reduction issue is real, especially where it’s the source of someone’s title or even job.

Brendan: Really. You outsource a department and then all of a sudden, you’re certainly not selling to that department. Right.? Because you’re basically saying, “I’m going to take your role and your staff and all your operation, and we’re going to do it here.”

How do you navigate that? In those situations, you’re not selling to that person or that department.

Sean: I have another Cisco story–hard to believe it’s been two decades since I worked there, and it’s a fundamentally different company now. In 1995 or so, we gradually became aware that we would have to put content on the web. In fact, most of our content would be consumed on the web and not as print. Who should manage it?

I was working in marketing. The VP of marketing gave the role of managing the marketing aspect of Cisco’s website to the people who were in charge of document distribution. My first thought was that he was crazy. But over time, I realized it was pretty insightful because the web was obsoleting their old role, but they had more of a process focus than most of the rest of marketing, and this gave them a stake in a future they could help create instead of resisting it. There were still a lot of changes in that group, but instead of them becoming a barrier, they helped to shepherd the change because it was under their control. They helped us eliminate most of the paper documents and move the content online.

That’s something that I don’t see happen as much. What I see more is that people who are going to lose are not valued for their strengths and relationships. They are pushed out or leave in what is ultimately a bigger loss for the company.

Everyone Affected Matters in a Deal

And they’ll often tell you in very specific terms and even to their detriment in the sense that you’re out there to fix it and in some way remove them from the problem. And thus, maybe their value to the company.

And yet they’ll tell you all these things, and you can go around and collect this stuff. What fascinates me is that those three or four levels up don’t hear any of this stuff. It’s either not that important at that level, or the people below don’t want them to find out because it illustrates that it’s not a tip-top running department.

This is one of the things that makes being in enterprise sales so interesting to me is that you really are in a position to understand a business in a way that people inside the company aren’t. Because you get to roam around. If you’re good at what you do, and you know a lot of people, and you travel up and down the organization, you get to see like all different departments and you get an unvarnished view of everything in a way that a CEO or a COO can’t, because people are going to give them happy talk or they don’t roam around and they don’t learn it directly. As a result, an outside sales executive can have a really good understanding of what’s going on inside your organization, just by virtue of the fact that they get to talk to and see so many people in so many operations.

Sean: It’s almost a journalist role in the sense that you’re trying to map the organization, but you’re also trying to collect stories. You’re trying to capture what’s actually happening on the ground. I agree with you that an outsider can connect the dots in a way that insiders find more difficult. I think there’s three different dynamics.

- In an organization that has been growing rapidly, employees are more open to ongoing change because it’s what they’ve experienced.

- In an organization that’s more or less steady state, people are resistant to change because what they have has been working. Their experience base is much longer in the status quo.

- In an organization that’s shrinking or in a turnaround, you have to be very careful about what changes you propose, because any change is viewed as a threat, right?

So how do you translate this collection of stories and put them into a coherent picture, narrative, or report? How do you translate your informal research into a story for your management and for the customer’s management?

Brendan: It depends upon the type of business or the type of solution that you’re delivering. When it was enterprise relational database management software, then you’d say, here’s why you should standardize on our platform and our tools.

And here’s why, and these things will all integrate together and you have a common knowledge base and common skill set among all the people across all these different departments. And things can integrate together, et cetera, et cetera. If you’re a consulting organization that does outsource development or management consulting, you’re going in, and you’re basically saying, here’s how we can help you make all these things work better.

And maybe there are a lot of little projects and you should hire us to do all of these projects in a big umbrella. And it’s a better umbrella because we understand where you’re going strategically at the highest level. And so the fixes that we deliver down at each of these levels will compliment that overarching strategy, so I guess it really depends on the situation.

I liken it to a journey and that is you have to paint a picture. You have to explain in a compelling way where they’re going to get to and how they’re going to get there.

Sean: So do you want to talk at all about any tips for how to capture and document the customer organization? As a salesperson or support person, you’ve got one foot in both worlds. Are there practices you can share?

Brendan: Yes. I’m a visual person who is more than a little paper centric. I use my version of the Miller Heiman blue sheet from Strategic Selling and Large Account Selling and so I’ve created a variation that maps out the key things that are the key components in a large deal or in a large account. [See Brendan’s Handout on Mapping the Customer Organization]

There’s an org chart on a grid and you can map out all the people that are in the org chart and then you can identify the various steps that are happening. And then in the org chart, you map out who’s uncovered who hasn’t, who you need to contact.

You can draw relationships between individuals, key individuals, and who’s in the, who’s in the inner circle and who’s the economic buyer and who’s your coach. And you can mark all those things on the org chart or on this one pager. And if you do it right, I used to do this on these formal printed out documents that Miller Heiman would create, and I can’t find anymore, but I’ve come up with my own.

I’ve been in multiple situations with customers where I’ve actually shown them this layout and this document. And in one particularly memorable example, the guy was at Merrill Lynch was looking over my shoulder as I’m working on it as we’re flying out for a formal presentation.

And as he’s watching, he asks “What is that?” To which I said, “It’s my account strategy plan.”

“Let me see that.” And he takes it from me. He’s reading through it and looking at the org chart and that’s the thing he fixated on. He then goes on to explain, “Oh, you’re missing this person and this person isn’t here anymore. They’re over here now. And then they’ve got this role and oh, you haven’t talked to so-and-so. You need to talk to so-and-so. I can make that happen.”

Which is the big takeaway… that your customer will literally help you strategize what needs to be done in order for that deal to get across the finish line.

And the beautiful thing about this is, and the reason why this is so useful to me, is it illustrates your professionalism and your knowledge of the account. They see that there’s a methodology there. They’re going about this in a systematic way.

And that immediately lowers the risk for your customer. They think, “Oh, I’m dealing with someone who knows what they’re doing. They’ve got a plan. They’re figuring out the fundamentals and the footwork and all those sorts of things.”

So that’s a long-winded way of answering your question, but that’s how I go about it.

The First Enterprise Sale Looks More Like a Project

Once you hit one or two “value realization events” for the customer–this is not when they purchase but when they have proof that the capabilities you offer have added value to their business–then I think it starts to transition to ongoing shared operations management. This transition is from land to expand.

Now I think you have these recurring reporting meetings, with dashboards and reports and conversations at multiple levels where you get woven into their operations cycle.

In project mode you may be meeting once or twice a week (or even daily some weeks). In expand mode you sync up with their operating cadence. You’re asking about what are your goals for next year and what needs to happen in the first and second quarter. What are the new goals for this quarter? What do we have to do to the product to support where you guys are trying to go? Because you’re at some level some way you’re back at the starting line for new efforts on their part.

In both phases, you rely on your understanding of the customer’s organization and updating your map as events warrant. But I think you start to work with different people. For example, during the initial purchase, you work with various “gatekeeper functions” that can say no but cannot say yes: purchasing, legal, security, IT standards groups, and the like. These gatekeepers are worried primarily about protecting the company from your future poor performance and less about how you will create value for their organization. So they are less concerned with the long-term business relationship.

In parallel, you need to establish working relationships with the right internal experts, managers, and leaders. You need to ensure the right members of your team are acquainted with and ultimately collaborate with their counterparts at the customer.

I think we’ve walked around the importance of the org chart. The fact that it’s going to take multiple conversations. You’re going to knit together relationships at multiple levels of your team. We didn’t talk about showing the customer your organization chart for the people who are going to support them. I think we took that for granted, but that’s probably worth calling out.

As a salesperson, you may be the primary or preliminary point of contact, but you’re ultimately going to have many other people in the mix.

Brendan: Right. And they all have a role to play. That strategy document that I outlined is very useful in terms of educating those people on the team about the people on the customer side so they know the relationships, they know the dynamics, they can see them as part of the briefing that I go through with them. But then I orchestrate having those other people involved. And going back to that conversation about the journey and the importance of the journey.

And by the way, in an enterprise account, there’s not one journey. You’re constantly working on a new project, right? There’s always another deal in the hopper. There could be multiple different deals happening at different time frames and see you’re juggling multiple deals.

But things are never really over. For example, when I talk about the journey with the customer, I’m educating people over and over again about this is where we are, this is where the process is, this is what happens next.

I will talk to them about who’s involved. It’s not going to be just me. Here’s your project manager for this engagement, or here are the three people that you were going to be involved with, or here are the tech support people that are you’re engaged with, or I’ll, I’ll bring the VP of engineering in to meet with them and discuss features or requirements or what have you.

Again, that’s part of the education process. So you’re learning about them and then you also want to make them aware of your enterprise. At some level, as an account manager or account executive in an enterprise sales role, you’re marshaling resources, you’re managing resources.

And so those resources are our people and stuff and attention spans and priorities and things like that. And if you’re good at what you do in that regard, you’re managing those things and you’re explaining. That’s part of the educational process too, along the way.

If you can figure those relationships out and start to introduce the right people as soon as practical, maybe not before the deal is done, but be prepared to put those together as quickly as necessary so that you’ve maintained momentum.

It’s about getting the progress to continue in some manageable way so that you’re moving towards the outcome. Sometimes the outcome is that there’s no deal here and you want to kill that. You want to kill it at some point because there’s no opportunity. That’s the natural outcome, but in a number of cases, you got a deal that’s highly qualified.

There’s a good fit. All the right ingredients are in place. Well, what you want to do is you want to make sure that you’re keeping the momentum going on. What can you do to make that happen? And that should extend itself past the consummation of the deal, the signing of the contract.

You’re planning for those things and setting up those relationships and making those introductions and so forth. You may be making those literally early in the sales process.

Sean: Your point about momentum is a crucial one. I would add two suggestions for how you can tell if you are building momentum.

First, if the people who are doing the technical evaluation, or the people who reached out to you to initiate the overall engagement, don’t start to introduce you to the gatekeepers, you have a problem. If they don’t tell you who you will be working with in purchasing, legal, and security, you are at risk. The evaluation may be more of a science experiment or learning exercise; it’s less likely to be a bona fide effort to add new capabilities to their mix.

Second, you should see the people who will use your product on a day-to-day basis show up. These employees will use your product as a regular part of their job. If they’re not initially part of the evaluation, that’s a red flag. If they don’t show up early in the evaluation process, your product will be evaluated by one group and then dropped through a hole in the ceiling onto the people who’ve got to use it. Your odds of success in creating real value for the customer are low.

Brendan: You may close the deal, get the purchase order and the revenue, but if it doesn’t get implemented, you’ve got this black eye. It’s like having a corpse in your account and your customers all know that guy killed them and so now you’ve got a failed project and, and if you’re an enterprise person and you’ve got a failed project, man, you have work ahead of you to overcome that.

We need to talk about enemies and the importance of getting rid of resistance.

Sean: Why does resistance occur? How do you make enemies? More importantly, how do you avoid making enemies?

Brendan: Earlier we discussed that there are winners and losers in a deal. Sometimes someone is not in your corner because they stand to lose political clout, budget, status or something they value if the deal goes through.

And in some cases, there are people in the company that are betting on the other vendor, right? If it’s a competitive thing, you’ve got your coach or your champion, and they’ve got theirs.

That’s the other situation that comes immediately to mind. Maybe enemy is a strong word. Perhaps an adversary or someone who’s not bought in. And I guess one of the things I would say about that is you try to do whatever you can to up to a point to try and at least make them neutral or indifferent to the outcome.

You can’t always do this. But to the degree you can win them over them or make them at least indifferent to the outcome is an important strategy… especially if you can actually develop a relationship with them after having gone to the trouble from their perspective and do what you could to assuage them.

Sean: I like your objective that we should all get along. But I have a slightly darker view. In some cases, especially where there’s a bigger change or where you’re bringing a significant improvement that is discontinuous with current practice, there will be people who will move on instead of adopt.

If they view their career as based on expertise with a particular product, tool, or infrastructure, and you’re replacing that foundation, they may decide to fight and move on if they lose. They may be unwilling to compromise. I think it’s always good to seek compromise, to look for the win-win, but it’s not always possible.

Brendan: Right. You can’t always win them over. If you’re outsourcing someone’s department and that department is going away, because you can do the same work for 80% of the cost with better quality since that’s your specialty, you’re probably not going to win them over.

You can ask your champion inside the customer organization why you are getting resistance. They can often provide more context on motivation and why a change would be viewed as a win or a loss.

Sean: When introducing a new product that requires a significant behavior or process change, I try to find the most conservative person who is still persuadable. I try to get them involved in the evaluation because they act as the demark between reasonable opposition and die-hard opposition. In many groups facing a significant change, you may lose 10-20% even after you are as accommodating and flexible as possible because they won’t change.

My approach is to know where folks stand. Don’t do anything–or do as little as possible–to harden opposition. You should be able to stand their position in a way that they view as accurate and fair. You don’t have to agree with them, but you have to understand them and empathize with their situation. Just that attitude and approach may soften opposition. It also allows you to explore additions or modifications to your offering that still provide the customer value but are more acceptable. If you engage with an open mind, you can often find ways to get more people on board and create more value than you had initially contemplated.

Sometimes I have prematurely characterized someone vocal in their opposition as a malcontent in my mind. But more often than not, they have legitimate reasons for not liking or not adopting a product that can help you improve the product. The last persuadable person who is still reasonable is an extremely valuable member of the evaluation team.

Brendan: That’s all I got. I think that’s it. That’s a pretty thorough chat about drawing a map of the customer organization.

Related Blog Posts

- Why is an Enterprise Sale So Complex?

- Enterprise Sales Requires a Project Management Mindset

- Q: How Does a First Time Founder Learn Sales?

- Address Technology, Management, and Executive Concerns To Close Enterprise Deals

- Video: Early Revenue For Enterprise Web Apps

Related document Brendan McAdam’s Handout on Mapping the Customer Organization

Image Credits

- Network Globe by Jozsef Bagota; licensed from 123RF.

- “Square Focused Targets” by Santima Suksawat (Licensed from 123RF)

- “Flat Organization” Licensed from 123RF

- “Calendar with Push Pins” by Mykola Komarovskyy Licensed from 123RF

- “Game Play Blackboard” by photka; licensed from 123RF