Video, slides, and edited transcript from a talk by Sean Murphy at Lean Culture on “Startups: What’s Hot, What’s Not” on Feb-22-2022.

Startups: What’s Hot, What’s Not Feb-22-2022

Transcript

Below is a transcript from the talk that has been condensed and edited for clarity with hyperlinks added for context.

Francis Adanza: Thank you for joining us today. My name is Francis Adanza, and I’m here to help out as the voice of the audience. This is meant to be an open conversation, so please use the chat box, and we will field your questions in real-time.

As someone who’s worked for multiple startups, I’m super excited for today’s presentation to hear what Sean has to say about what’s hot and what’s not in the startup ecosystem. Sean has taken an entrepreneurial approach to life since he can drive over his career. He’s helped dozens of startups from life sciences, expense management, electronic design automation, text analytics, dev tools, and many more scale their customer acquisition processes. Some of the community events he also participates in are the Silicon Valley Lean Startup Circle, the Bootstrappers’ Breakfast, and the Founder’s Mastermind. So if you’re looking for other ways to engage with Sean, those are some other avenues as well.

So with that said, Sean, it’s a pleasure to have you today. Thank you for your time and this presentation. I’ll let you take it from here.

Sean Murphy: Thank you very much, Francis. Please help us understand who is on the call. Please type into the chat if you’re a founder, consultant, investor, or other, and what flavor of other is interesting to see who’s in the audience. All right, cool. “Founder, consultant, founder, founder, consultant, founder, other, founder, attorney for startups, founder, consultant, retired director of engineering, founder from Singapore expanding to the US.” We have a founder-heavy crowd.

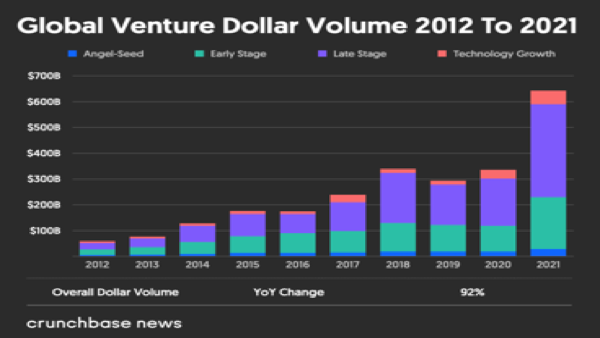

Sean Murphy: So the most significant thing about 2021 is that it’s the largest year for funding since we’ve been keeping track of it at $643 billion, I believe is the number. And if you look at that trend, it’s almost double 2020. And if you go back a decade, it’s like six times larger. So there’s a lot of money flowing into various stages of startups.

Key Takeaways

- Everything is Hot: Large increase in investment in startups in 2021

- Now more than 1,000 Unicorns (as of Feb-2-2022)

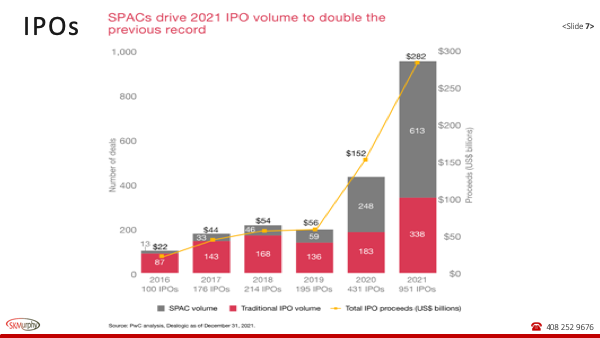

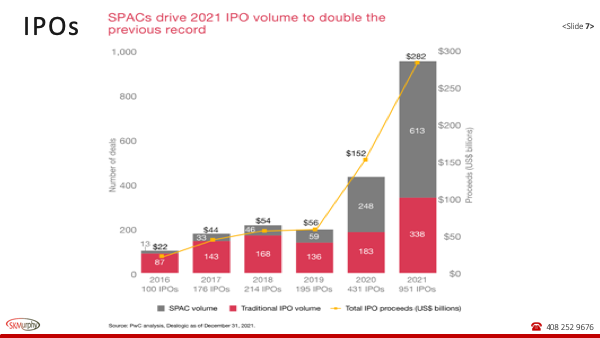

- 2021 IPO count and proceeds at record levels

- 2020-21 was a period of “Withdrawal and Return” for Founders

- Be guided by your expertise and the customers you want to serve

Sean Murphy At a high level right now, everything is hot. There’s been a large increase in the investment level. There are now more than a thousand unicorns. And a unicorn is a company that has achieved a billion-dollar valuation that’s not yet public. That term was coined in 2013 by Aileen Lee at Cowboy Ventures. She found 14 that were still private. Today, there are more than a thousand. And with that, the count and the amount of money in IPOs, Initial Public Offerings, is also at record levels. And that’s putting money back into the ecosystem that’s then used to fund new startups.

We’re going to talk about 2020 to 2021 being a period of withdrawal and return for founders just because of COVID and kind of the imposed changes. And when everything is hot, I think our advice is to be guided by your expertise and the customers that you want to serve as a final thought.

Outlook in Early 2020 was Grim

“Since March 11, 2020, about 300 U.S. startups have laid off about 30,000 employees”

NVCA April 27, 2020: Startup Ecosystem Faces Capital Crunch over Coming Months“Effects of economic slowdown brought on by COVID-19 will absolutely be seen in VC. Aggregate VC dealmaking has remained strong so far. We expect Q1 deal flow to be largely unaffected, but we do expect a decline in total venture transaction volume over the next few quarters.”

PitchbBook Q2-2020: COVID-19’s Influence–US VC Market Braces For Impact of Crisis

Sean Murphy: We are not where we thought we would be in early 2020. So things have turned out quite differently than where we thought we would be 18 months ago.

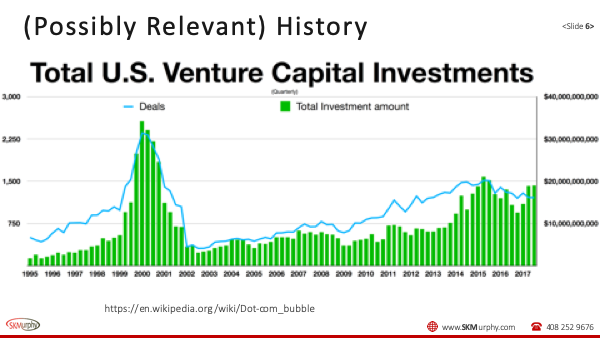

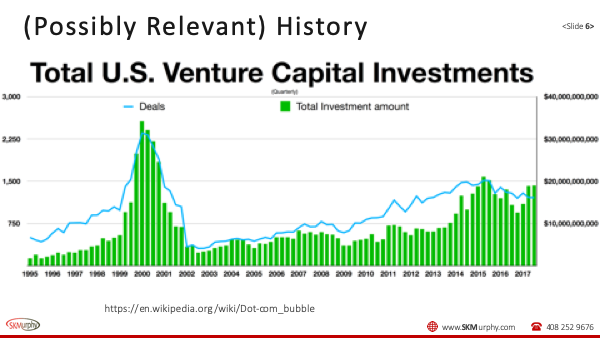

Sean Murphy: This is a little bit of a look back at history between 1996 and 2001. That curve looked to me a little bit like the curve we just looked at for 2017 to 2021. And then there was a reversal. So hopefully that doesn’t happen. The peak in 2000-1 was in the low 30 billions. The 2021 number was 643 Billion. That about 20 times higher, so that gives you an idea of the scale of venture investment today versus the dotcom boom.

Sean Murphy: Here’s the IPO counts. And you can see that in the last two years, they’ve tripled. The amount of money has tripled between 2019 and 2020, and doubled again almost between 2020 and 2021. So a lot of money is flowing in. The SPACs or the Special Purpose Acquisition Vehicles, it’s essentially an IPO for a player to be named later that then pulls another company public by acquisition.

Francis: Sean, looking at the data you just present: and if history was to repeat itself what should the founders on this webinar do? Would you recommend they “raise now while it’s hot” because it won’t be there in the next year or two?

Sean Murphy: Money is never free. The question is, at what terms and what do you plan to use the money for? So if your business needs the funds, then you should definitely raise it now, but I think raising an anticipation of some future requirement can be a tricky proposition. We’re living a little bit in unprecedented time. With the pandemic and this level of investment, it’s hard for me to predict what comes next. I am sorry, I don’t have a crisp answer for your very practical question. Money is never free: investors are never really giving away money. So you can end up in a situation where you’ve signed up for something you can’t deliver on, and that’s got problems as well.

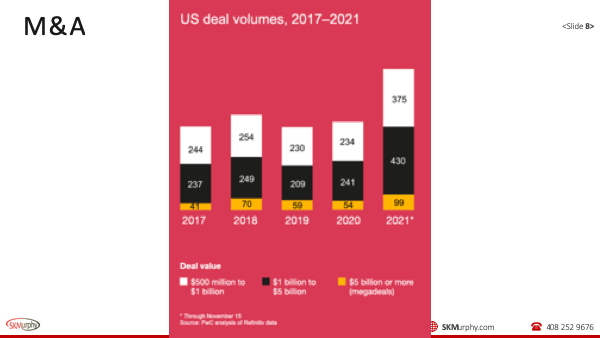

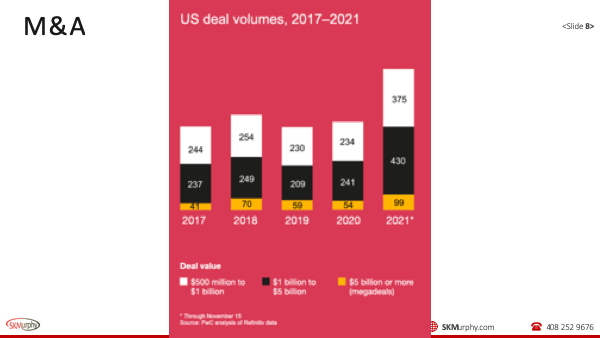

Sean Murphy: Another factor to bear in mind: money flows back to investors as a result of mergers and acquisition. Here again, we see a substantial increase in deal volume in 2021. The yellow band are deals that were $5 billion or more. And so that’s almost double the prior year. And the other two tiers are also up.

Audience member: Taking funding starts the clock ticking for when you need to show a big return. And if you take money in the current environment, the expectation of a big exit is high. So you may definitely be signing up for something that you’re going to have trouble delivering on.

Sean Murphy: Here’s a little bit on the unicorn deals. As you can see, that’s been building steadily and now in 2021 they are way up. For me there are a couple challenges with this unicorn model. I think in the beginning, after Aileen Lee gave them a sexy name, they might have been driven more by bragging rights. Founders can choose to trade deal terms for valuation, but if they don’t hit their targets their payout may drop quite a bit. From the investor point of view, they still just need a few big winners. Money is never free. You should raise what you need with a prudent margin, but if you raise twice or four times what you need a lot of that money will be more expensive in terms of equity than if you had taken a smaller raise and hit your targets. And there’s no point in raising twice what you need or four times what you need if you don’t have a plan to spend it intelligently.

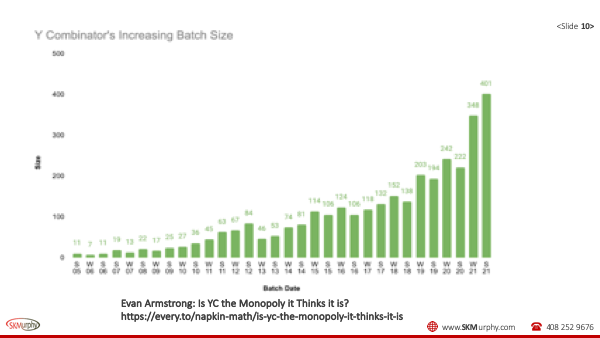

Sean Murphy: Here’s another interesting set of data. So Y Combinator is a well respected accelerator for startups. And they started back in 2005 and their cohort size, the number of startups that they were supporting at any one point was in the teens, right. And they kind of refined their model and they took it up in the 40 to 60 range. And then more recently, they were around 100 plus or minus. So now in the last two years, they’re at 200 and now 400. So even they are dramatically increasing the number of startups that they’re taking in.

One thing that’s interesting to me about this is that with a cohort of 27, let’s say, or even a cohort of 46 other startups, you can put all those people into the room and have a conversation to get to know people. But a cohort that’s got 400 startups in it is a fundamentally different model. And that’s up from 200 plus in the prior two years, and then in the 100-125 range for about six years before that.

Just because YC was historically very successful, it’s not clear that model actually scales to the sizes that they’re running it at right now.

I have a question for the audience member who is currently in a Founders Institute cohort. I don’t have the data on their cohort sizes. How many startups are in your cohort at the Founder Institute?

Audience Member: Yeah, that’s a great question. I should know, but I know in my personal work group, we were supposed to have about seven startups. So I imagine there’s 50, I want to say, but it could be a little more or less. When you say YC is playing a numbers game, what is the percentage that are becoming alumni out of that 400?

Sean Murphy: Well, historically almost all of them make it to Demo Day and become alumni. I know that Founders Institute has a high washout rate: I think only about 30% of those who are accepted and start the program graduate. As to how many are actually ultimately going to have an exit of some sort, either get acquired or go public, that’s harder to predict, right.

Francis: Being in this cohort doesn’t necessarily mean you raised some of that money that you showed on the previous graph.

Sean Murphy: YC provides $500K in seed funding. I know that a high percentage of YC startups get funding, normally a few million. They run an auction twice a year, what they call Demo Day, that attracts a lot of investors. Part of the dynamic that has contributed to their success may be due to their two cohorts–and therefore two Demo Days–a year. This means that the cohorts have gotten bigger as opposed to running four or now eight and keeping the size at 50 startups. I have no inside information on their operations so this is purely speculation on my part. To me it would seem that more frequent but smaller cohorts would be better for founders but I’m not privy to their thinking. They have their own approach and it has served them well to date.

Why So Many Unicorns?

- Investors play the odds, looking for the big winners

- Unicorns increased upside on the big winners

- Diversification

- Minsky Boom?

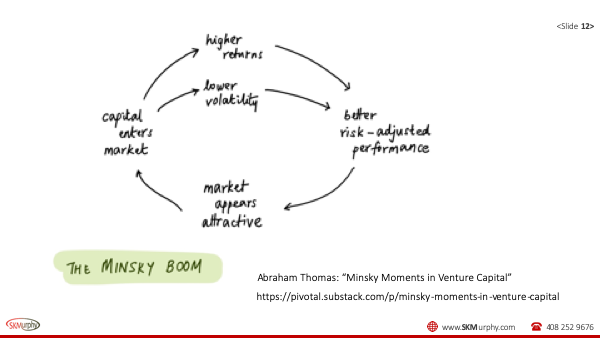

Sean Murphy: So why so many unicorns? So for investors, they’re looking for a few big winners. So they’re hoping that one or two winners essentially justifies their fund in the… There’s another factor at work here that’s potentially called a Minsky Boom. Minsky is this economist that said, “If you look at the way that an investment flows, when you see money flow into a sector, it can make it look safer than it is.”

Sean Murphy: So in a Minsky Boom, as capital flows into a market, and we’re seeing enormous capital flows coming in, then you see in the near term kind of higher returns, the perception of lower volatility and what looks like better risk adjusted performance because as money comes in, there’s more investments. If you make a seed round, there’s somebody to do the A, there’s somebody to do the B. But at some point, the merry go round starts to run the other way, and you get something like 2001 where there’s many fewer exits, the market appears unattractive and there’s down-rounds or kind of involuntary exits of different sorts. So the question is, if and when that comes, given the amount of money flowing in the venture.

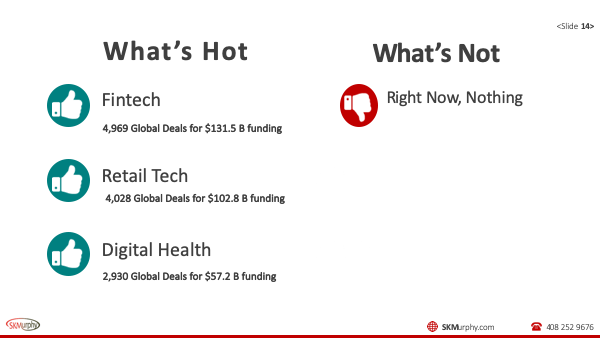

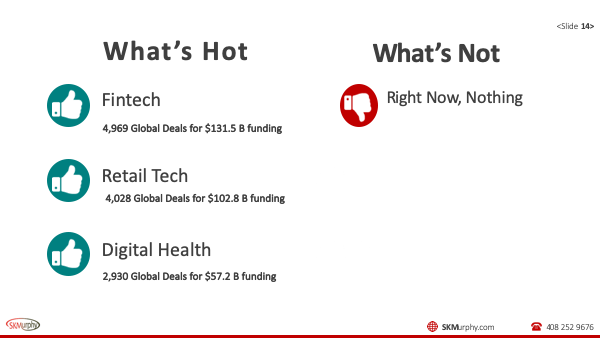

Startups What’s Hot: Fintech, Retail Tech, Digital Health

Sean Murphy: So, the three hottest areas are FinTech, retail tech, and digital health. And these are global numbers. So there was about 5,000 deals that put 131 billion of funding into FinTech. Retail tech did about 4,000 deals, got about 100 billion. And then digital health got about 3,000 deals and did 60 billion.

Audience Member: If you plot startup valuation, there’s a big inflection point right at a billion, which would be some evidence people are going for bragging rights. I think people would rather have $1 billion valuation than 990 million. And I’m not sure that, in and of itself, is worth anything. Right now, it doesn’t appear that much isn’t hot or at least from a sector level.

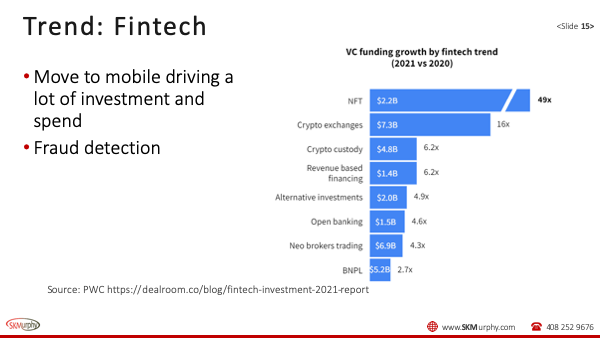

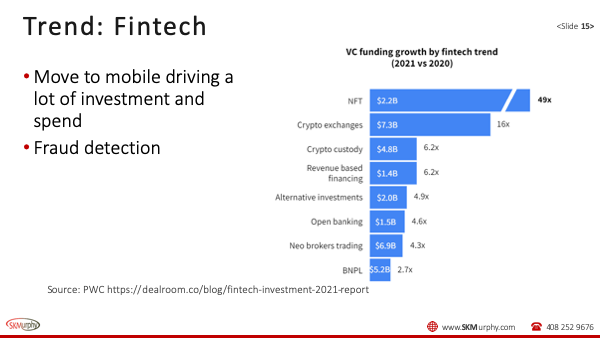

Sean Murphy: FinTech, just to dig in a little bit on that, seems to be driven a lot by both the move to mobile as a platform, and then the need for better and better fraud detection as we move to a globalized economy. And then they lump crypto and NFT into FinTech. So that’s also a very small portion of the total investment, but it’s growing very rapidly.

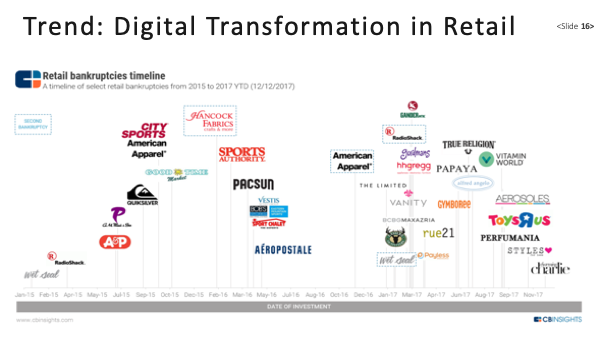

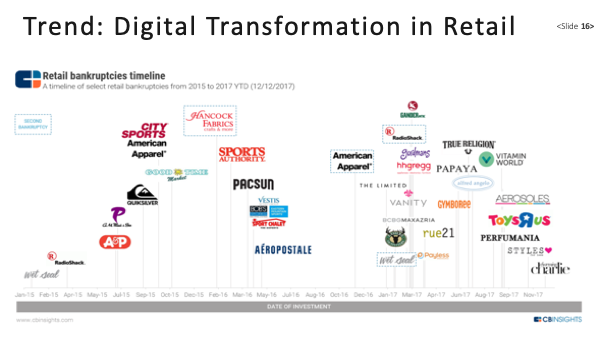

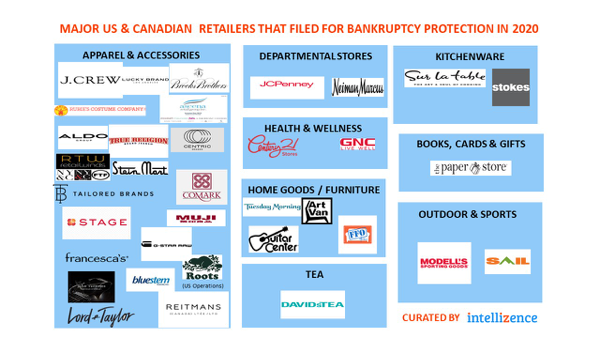

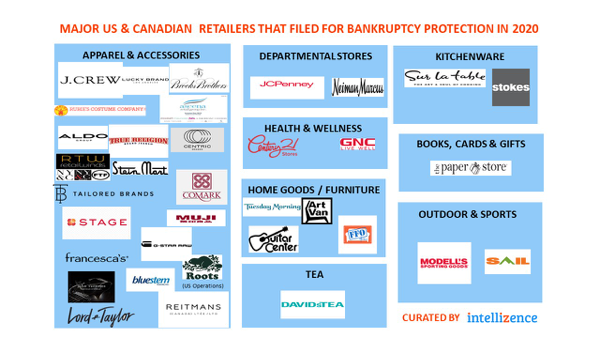

Sean Murphy: We talked about retail getting a lot of money. At the same time, we’re seeing a digital transformation in retail. A number of old and established retail firms are going bankrupt. And my hypothesis is they haven’t executed the transformation to digital technologies. They’re using older methods and older technologies, and they’ve unfortunately been left behind.

Sean Murphy: Here’s a set of tombstones for a number of well-respected retailers.

Trends Digital Health

- Emergence of data ecosystem – taking a holistic approach

- Evolution of medical devices:

- Mechanical -> electrical/electromechanical -> software control -> Machine Learning Models

- Single sensor to multiple sensors / multiple modalities

- Software as a medical device

- Increased use of data to drive treatment

Sean Murphy: And then finally in digital health, we see a couple of things going on. Data’s becoming increasingly important. You see medical devices transitioning from mechanical to electrical, to electromechanical, and now software control. Essentially, software is a medical device where mobile phones and other platforms are providing functionality that used to require specialized hardware, and they’re either leveraging sensors on mobile devices or they’re incorporating multiple new sensing modalities to improve the quality of care and the quality of outcomes. And you see increased use of data gathered outside of the clinic to drive treatment.

2020-21 Withdrawal and Return

- Innovation & creativity can flow from “withdrawal and return”

- Break in routine can provides new and useful perspectives

- A “New Normal” in 2023 that blends 2014-2019 with 2020-21.

- We rediscover the value of

- face-to-face communication

- in-person experiences

Sean Murphy: The other thing that we’re speculating on, just based on what happened in some ways after the dot-com crash, the COVID kind of created this “stay at home”, this change in perspective, this break in routine, and one hypothesis we’re going to see a “new normal” in 2023 that doesn’t necessarily return to 2019, but blend some of the things we’ve learned with 2020 and 2021. So, more use of online technologies, more use of distance collaboration tools. I think at the same time, we’re going to rediscover or be reminded of the value of face to face communication and in-person experience.

“I’m in the US for the first time in 2 1/2 years, and talking face to face with people is immensely more productive than talking over Zoom. If Zoom were the default and someone just invented face to face, it would seem like an amazing step forward. One way to figure out where we’ll reach equilibrium is to imagine if face to face were in fact a new invention. How would early adopters take advantage of this amazing new technology?”

Paul Graham (@paulg) Feb 17, 2022

Sean Murphy: This was a recent funny insight by Paul Graham that I think is important to bear in mind as we come out of our groundhog holes and move forward.

SKMurphy View: Promising Areas

-

- Materials Science: Novel compounds / Organic compounds

- Energy and Environment

- Battery technology

- Recycling & renewables

- Privacy / Vendor as Fiduciary: Death of cookie

- Video is the New HTML: Ubiquitous editing tools enable artists & multimedia

Sean Murphy: I wanted to point out four areas that may offer underappreciated opportunities to founders who have an appropriate background.

- There are a number of new compounds and novel organic compounds coming out that are driving new possibilities.

- Battery technology continues to improve, recycling and renewables continue to improve.

- It looks like both Google and Apple have decided that they will make it much harder to track. So the cookie, which is the foundation for much of our user tracking, is going away. We see stricter new privacy regulations like GDPR in Europe and CCPA in California. Founders targeting people under 18 and particularly under 13, where the privacy protections have become much more stringent, need to be aware of this. In addition, I see that some vendors and new startups are positioning themselves more as fiduciaries protecting your data instead of paparazzi spying on you to sell your actions and personal information to third parties.

- And then finally, a set of low-cost editing tools are making video the new HTML. In the early ’90s, as the web came in, HTML became this universal interchange medium. I think HTML is giving way to video because it’s easy to edit and repurpose: we see many artists starting companies of various sorts.

So, my question for the audience is, what trends do you see at work here? What did we miss? What did we overlook? What did we get wrong?

Audience Member: GPT-3 storytelling in AI.

Sean Murphy We didn’t highlight AI probably as much as we could have. AI is kind of an enabling layer that runs across all these verticals. Sean Murphy:

Francis Adanza: Supply chain management. When you showed all of the bankruptcies in retail some of that is due to supply chain issues. When you look at almost any enterprise 10-K or earnings report, supply chain is a major area of concern. At that strategic level, supply chain seems like an area where tech could have more of an impact.

Sean Murphy: I agree. With the benefit of hindsight it’s clear that too many firms focused on taking cost out of the system, loading up on more risk than they realized. .

Audience Member: What about VR? Will the Metaverse be big?

Sean Murphy: I’m curious what other people feel, but my answer is the more interesting aspect of it is not that we’re living in some virtual space, but that augmented reality technologies provide an information overlay that allows you to collaborate more effectively with other people in the real world, or to provide helpful context for real-world tasks. I see more possibilities for augmented reality than virtual reality. I think virtual reality becomes more of a content play with the pluses and minuses of a content play, where AR could be a horizontal play for all kinds of more effective collaboration.

Audience Member: is bootstrapping still viable?

Sean Murphy: My answer is yes but as the founder of the Bootstrappers Breakfasts it’s clear I have some bias. I encourage founders to seek funding when their startup both merits and requires it for growth. But all too often, founders seek investment before they have proof of value, and a debugged business model that can accept outside funding and return growth and profits over time can pay investors back.

Not every business, especially an early-stage startup, is held back by funding–funding on a scale that a professional investor needs to put in play. You cannot always predict or simulate the future based on your current data and depth of understanding: sometimes, you have to run small experiments to determine if your product idea is feasible, viable, and likely to be profitable.

Another thing that’s happened over the last two decades is that many technologies have been brutally commoditized by prior investment. We see open-source hardware and software as a significant competitor to the product concepts that teams bring us. If you can determine how to take advantage of open source and commoditized services like AWS and Azure, you may need 10% or even 1% of what was required a few years ago. Today you can do quite a bit of prototyping and support a critical mass of early customers with a few thousand dollars when five years ago it might have cost ten times as much, and a decade ago it would have been more than 100K. In many cases, bootstrapping allows you to build a much stronger case for investment than simply presenting a pitch deck without any actual proof of desirability or feasibility.

Audience member: Smart PPE

Sean Murphy: I hope you are right and we develop quite a bit of “smart PPE.” Probably what we call HVAC–heating, ventilation, and air conditioning–is going to get a lot smarter and a lot more inimical to various kinds of viruses and unfriendly bacteria.

Audience Member: Space has gone through a significant transition in the last decade or so. SpaceX and some other launch technologies have changed the game with regard to how easy it is to put systems up in orbit. And we’ve seen a lot of growth fueled by investments in these proposed large constellations like Starlink. There is a lot more in orbit there used to be. And if the SpaceX Starship becomes operational over the next couple of years, that will decrease the cost orbit by two orders of magnitude. You mentioned things being commoditized: putting systems in orbit will be commoditized. So space may become an exciting area for entrepreneurs. There have been a lot of recent space-related SPACs and IPOs as well. Even though it’s still a small industry, it’s transformed quite a lot in the last decade.

Sean Murphy: One good example of open standards driving new opportunities are CubeSats, they are 10cm cubes that are stacked into the same launch vehicle. They are similar in concept to the “multi-project wafers” that the semiconductor industry used to allow multiple design teams to split the cost of one wafer lot for prototyping, except these are going into orbit. There are a lot of startups who have launched or are designing and planning to launch CubeSats.

Francis Adanza: I think that wraps up today’s session on “Startups: What’s Hot, What’s Not.”Many thanks to Sean and the SKMurphy team for your time in this presentation.

May 2022 postscript: what a difference 3 months makes; startup world is now in a recession

- Y Combinator sounded the klaxon in May-19-2022: YC Advises Founders to Plan for the Worst. My key takeaway was #6 on their list: “For those of you who have started your company within the last 5 years, question what you believe to be the normal fundraising environment. Your fundraising experience was most likely not normal and future fundraises will be much more difficult.”

- David Sacks / Craft Ventures: Operating during a downturn

https://www.youtube.com/watch?v=vBkzm4a7iY4 key points:- Best scenario is to not have to raise capital right now. This condition may last for another 12-15 months.

- Slower growth at a 24-30 month or longer runway is much better than high growth on a one year runway. Break-even cash flow is a good target if you can hit it.

- Cut any sales / marketing spend that does not have an immediate (less than 3 months) payoff.

- Except for raising money most things get easier: for example less competition for good candidates and ads become much cheaper.

- For context here is the “Sequoia memo” from 2008

https://www.slideshare.net/eldon/sequoia-capital-on-startups-and-the-economic-downturn-presentation?type=powerpoint

SKMurphy Take: As in 2002-3 and 2008-9, VCs are giving advice on how to bootstrap. Bootstrapping is always a viable approach; those who have had some practice will do better in the next two years than those who were counting on another investment round to solve current challenges.

Related Blog Posts and Articles

Unicorns / Aileen Lee

- https://techcrunch.com/2013/11/02/welcome-to-the-unicorn-club/

We found 39 companies belong to what we call the “Unicorn Club” (by our definition, U.S.-based software companies started since 2003 and valued at over $1 billion by public or private market investors) with 14 still-private companies on our list. - https://www.bizjournals.com/sanjose/news/2019/09/23/exclusivevc-who-invented-unicorn-label-sees-room.html

- https://www.inc.com/minda-zetlin/unicorn-1-billion-valuation-vc-venture-capital-aileen-lee-cowboy-ventures-elite-universities.html (2018)

SKMurphy Blog Posts

- Investment Presentation Formats

- Three Points About Seeking Investment

- 8 Tips for Evaluating Funding Alternatives

- Ben Kaufman on “What Raising Money Means”

- Book Club: Traversing the Traction Gap by Bruce Cleveland

- James Jimenez on Exit Strategies for Startups

- A Holistic Approach to Launching a Bootstrapped Startup

- Planning in a Bootstrapped Startup: a Model from Will Kamishlian

- Success for a Bootstrapper

- Tips For Modeling & Managing Cash Flow

- Five Serious Financial Mistakes Bootstrappers Can Avoid

- Doing Less with Less

- Q: Should I Tap My 401K to Bootstrap?