Here is a simple method for taking stock of the business assets you rely on to attract prospects, differentiate your offerings, and deliver value. You should also assess where you need to renew or upgrade an asset.

Taking Stock of Your Business Assets

Taking stock of your business assets, analyzing what financial, intellectual and social capital are valuable leads to the discovery of new assets, new methods and new abilities that your organization needs to refine or acquire. Like organizing a tool shed: some things need to be sharpened, some need to be replaced, and some are missing. But as tedious as it sounds, taking stock generates new awareness for what you do well and what should be improved. Regular reflection leads to new and better assets which lead to more review which lead to more new and better assets.

Taking stock of your business assets, analyzing what financial, intellectual and social capital are valuable leads to the discovery of new assets, new methods and new abilities that your organization needs to refine or acquire. Like organizing a tool shed: some things need to be sharpened, some need to be replaced, and some are missing. But as tedious as it sounds, taking stock generates new awareness for what you do well and what should be improved. Regular reflection leads to new and better assets which lead to more review which lead to more new and better assets.

When taking stock, these are four critical aspects to think about:

- What’s in your showcase?

- What is at risk for commoditization or obsolescence?

- What needs maintenance?

- What is your competitive advantage?

What’s in your showcase?

The goal of this particular exercise is to identify what your customer base is looking for and what assets you need to fulfill that criteria.

You don’t necessarily want to broadcast all of your capabilities. Consider how a car salesman outlines the benefits of a particular automobile. They don’t focus on the material that was used in the catalytic converter, but instead describe the leather upholstery, satellite radio, gas mileage, trunk space and what it feels like to drive this car. This is what most customers want to know: will it meet their needs. Your showcase are the key aspects of your offering that attract inquiries and interest from prospects.

Another example: which heart-rate monitoring device do you want used for the test of your unborn child. If the doctor goes into a lot of detail about how an optically pumped magnetometer functions, that matters much less than avoiding the need for a lengthy, claustrophobic MRI scan.

In other cases where the technique is your product, such as with website development, the “how” is as much of a selling point as the “why.” You know how to develop a site with WordPress/Wix/Weebly, how to manage it, and how to fix any bugs that might creep up. But even then, you are tailoring your pitch to the customer, working with words and tools they are familiar with and omitting irrelevant, in-house information.

What is at risk for commoditization or obsolescence?

“It’s always been done this way” is rarely the foundation for a good business strategy.

Before desktop publishing, the best way to layout a complicated image for printing was to cut a rubylith.

Rubylith is a translucent sheet of thin plastic. A craftsperson would carefully cut the ruby, knowing that the parts it covered would reflect the light when the plate was created. It was difficult and painstaking work.

That’s all obsolete now. An hour of cutting a ruby is replaced by two clicks in Illustrator.

Here’s the truth: images cut by hand with a rubylith weren’t better. They were simply the best available option.

Seth Godin “The Truth About Rublylith“

Rubylith was also used in the specification of semiconductor designs before electronic design automation allowed us to use computers to design computers. Again, artists had a strong attachment to “cutting rubylith” and were slow to learn the new tools. You have to be careful that skills you have mastered with patience and considerable effort, and now have real expertise in, may have been obsoleted by new methods and technologies that in some cases bear very little resemblance to the traditional method, but deliver superior results from the point of view of your customer.

Look at your assets objectively. Listen to what prospects are asking for and learn to let go of the obsolete or commodified aspects of your business. And beware of sunk costs, where you’re held hostage to past decisions.

What needs maintenance?

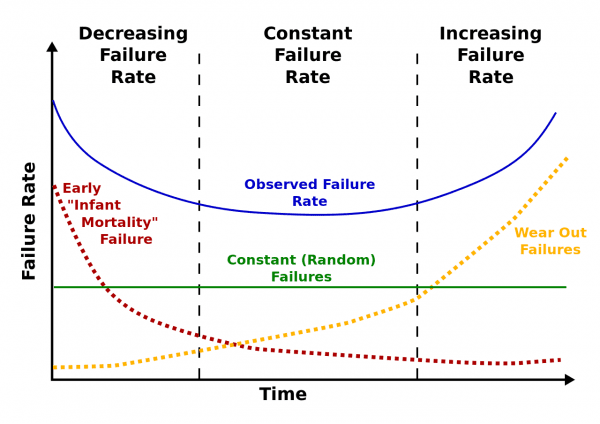

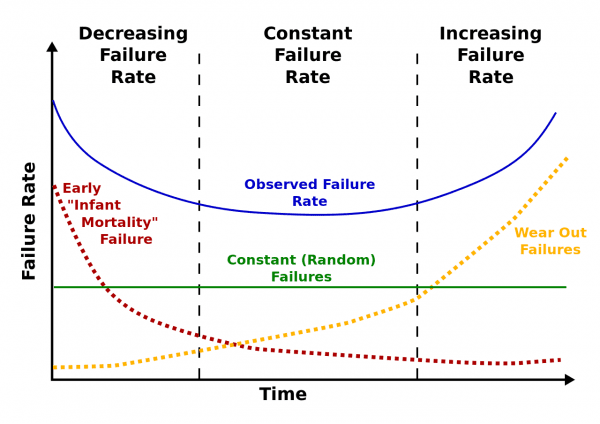

Knowing when an asset needs maintenance is both difficult and crucial. In terms of expertise/technology, the bathtub curve is one method of identifying when something has gone stale. Following the silhouette of a classic bathtub, the graph starts high (signaling lots of initial errors) then swerves down to a flatline (meaning you’ve mastered the technique and there are virtually no more errors). The amount of errors increase again when an organization rushes to catch up to their new environment and better equipped competitors. If you’ve been flatlining for a while, there’s a real danger of obsolescence and now’s the time to take stock and look around.

The goal is to keep your niche. Look at where you are situated and make sure you’re equipped to deal with upstream input and satisfy downstream demands.

Maintaining social capital is a bit different

Maintaining shared trust and mutual connection with someone requires a proactive, personalized approach. Setting a “check-in cycle” for contacts is highly recommended. Customers, partners, suppliers and manufacturers should be regularly contacted so that you are constantly aware of what is expected of your organization and what you can realistically deliver.

People you have shared a success story with, typically LinkedIn contacts, can be messaged more on a yearly basis. Making introductions is another method to staying on someone’s radar. These messages and introductions, though, should be personalized and should illustrate the unique methodologies and services you bring. Proactively share your meaningful personal insights. Don’t default to the common wisdom message of the month. Instead provide thought leadership, which requires you to discern important events and trends at work in the present, predict their likely effects, and offer perspective and actionable advice in time to have an impact.

Which business assets contribute to your competitive advantage?

The goal is to be easy to discover but hard to copy. Discoverability means that you are constantly showcasing all the solutions you offer. And the more you’re talking in terms of the customer’s operating reality–i.e. user experience–the harder it is for a competitor to copy key aspects.

Copiability refers to the creation of your particular niche and customer base as a means of eliminating competition. The drive to narrow your niche could come directly from your customers. They might ask for a cheaper version of an existing product or service. They may be unhappy with the way you’re operating compared to other businesses. Or maybe you’re trying to sell something that your clientele have never asked about. In which case, be careful of not building up business assets for a Swiss army knife when all your customer wants is a pair of scissors. If all they want is scissors, and you can make scissors really well, sell the product that’s easier to manufacture, maintain, and pitch.

This ties into Blue Ocean Strategy, where the main idea is to be very clear about who your organization is serving and capturing uncontested market space. If you really understand your customer’s needs then it doesn’t matter whether you have the resources to compete with massive death star level companies like IBM. So focus on developing assets that will satisfy your prospects, and not on assets that will simply “round things out.”

Summary

There is no universal list of business assets that applies to every product and company. My intent is to encourage you to take stock periodically of the assets you rely on to attract customers, differentiate your offering from competitive alternatives, and deliver value. Understand how changes in customer needs, the technology landscape, the economy, and the competitive arena may have obsoleted some assets and left others in serious need of renewal. Give consideration to how you might re-purpose or redeploy certain assets to efforts that may yield more revenue, more profit, and higher customer satisfaction.

SKMurphy Can Help

Related Blog Posts

- Thought Leadership: A Briefing For San Bruno Rotary

- William Feather on “Dead Business”

- Treat Social Capital With the Same Care as Cash

- Only Share What You Are Certain Of In Uncertain and Evolving Situations

- Making Business Decisions in Uncertain Times

- Uncertain Times

Working Capital Series

- A Primer on Business Assets for High Technology Startups

- A Practical Introduction to Financial Capital for Bootstrappers

- Basics of Intellectual Property for Bootstrappers

- A Practical Introduction to Intellectual Capital For Bootstrappers

- A Practical Introduction to Social Capital for Bootstrappers

- Building, Borrowing, and Keeping Trust

- Taking Stock of Your Business Assets

- How to Leverage Current Business Assets For Growth

- A Holistic Approach to Launching a Bootstrapped Startup

Image Credits

- “Green Check Checklist” licensed from 1223RF #30686078

- “Bathtub Curve” from Wikipedia article “Bathtub Curve” This image is a work of a U.S. Army soldier or employee, taken or made as part of that person’s official duties. As a work of the U.S. federal government, the image is in the public domain.

Pingback: Ed Ipser: Sean Murphy Asks Probing Questions To Address Core Issues